will capital gains tax rate change in 2021

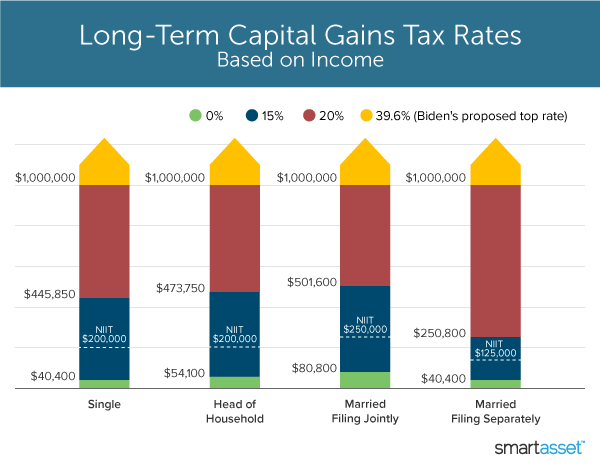

0 0 to 40400 or less 0 to 80800 0 to 54100 0 to 40400. The proposal is bumping this up to 396.

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

15 40401 to 445850 80801 to 501600 54101 to 473750 40401 to 250800.

. If your income was 445850 or more. On the capital gains side the idea is. If your income was between 0 and 40400.

0 0 to 40400 or less 0 to 80800 0 to 54100 0 to 40400. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288. 20 445851 or more 501601 or more 473751 or more 250801 or more.

4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. Another would raise the capital gains tax rate to 396 for taxpayers. To take the capital gains top rate to 25 for people earning more than 400000 per year and making.

In 2021 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. Joe Biden says this tax increase funds a 18 trillion dollar. Tax rate Single Married filing jointly Head of household Married filing separately.

There are exceptions to this such as when it was 15 from 2004 to 2012. Capital gains tax rates on most assets held for. However thats not to say that capital.

While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories will likely see no change. Historically capital gains tax has sat around 20. Or sold a home this past year you might be wondering how to avoid tax on capital gains.

Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. If you are filing your taxes as a single person your capital gains tax rates in 2021 are as follows. Long-term capital gains rates for 2021.

The current long-term capital gains tax rates are 15 20 or 238 for higher income taxpayers. Long-term capital gains rates for 2021. Tax rate Single Married filing jointly Head of household Married filing separately.

Ad Compare Your 2022 Tax Bracket vs. The rates do not stop there. If your income was between 40001 and 445850.

As a business seller if you are in either the low or mid earning bracket any proposed changes will not affect you so proceed with the sale of. Ad If youre one of the millions of Americans who invested in stocks. One of the proposals Congress is considering sets the top rate for taxing capital gains at 25 up from 20 under current law.

You will be taxed at your ordinary income tax rate on short-term capital gains. 20 445851 or more 501601 or more 473751 or more 250801 or more. 2021 the date House.

Additionally a section 1250 gain the portion of a. 20 445851 or more 501601 or more 473751 or more 250801 or more. 0 0 to 40400 or less 0 to 80800 0 to 54100 0 to 40400.

In 2020 the more income you make the higher capital gains tax rate you pay as well. Currently the capital gains tax rate for wealthy investors sits at 20. Assets other than stocks may have different rates for capital gains taxes.

The tables below show marginal tax rates. Long-term gains still get taxed at rates of 0 15 or 20 depending on the. There is a change on the horizon which can take place as soon as 2022.

Long-term capital gains rates for 2021. Depending on how long you hold your capital asset determines the amount of tax you will pay. Short-term capital assets are taxed at your ordinary income tax rate up to 37 for 2022.

Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. Tax rate Single Married filing jointly Head of household Married filing separately. Long-term capital gains are.

4 rows The proposal would increase the maximum stated capital gain rate from 20 to 25. Capital Gains Tax Rate 2021. 15 40401 to 445850 80801 to 501600 54101 to 473750 40401 to 250800.

To see how the thresholds will change from 2021 to. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. Discover Helpful Information and Resources on Taxes From AARP.

Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. 7 rows 2021 federal capital gains tax rates. Those changes are expected to cost up to 35 trillion.

Long-term gains still get taxed at rates of 0 15 or 20 depending on the taxpayers income while short-term capital gains on assets held for a year or less are considered ordinary income for tax purposes. 15 40401 to 445850 80801 to 501600 54101 to 473750 40401 to 250800. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35.

The income thresholds for the capital gains tax rates are adjusted each year for inflation. Long-term capital gains taxes are assessed if you sell investments at a profit after owning them for more than a year. Your 2021 Tax Bracket to See Whats Been Adjusted.

Dividend Tax Rates In 2021 And 2022 The Motley Fool

Made A Profit Selling Your Home Here S How To Avoid A Tax Bomb

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

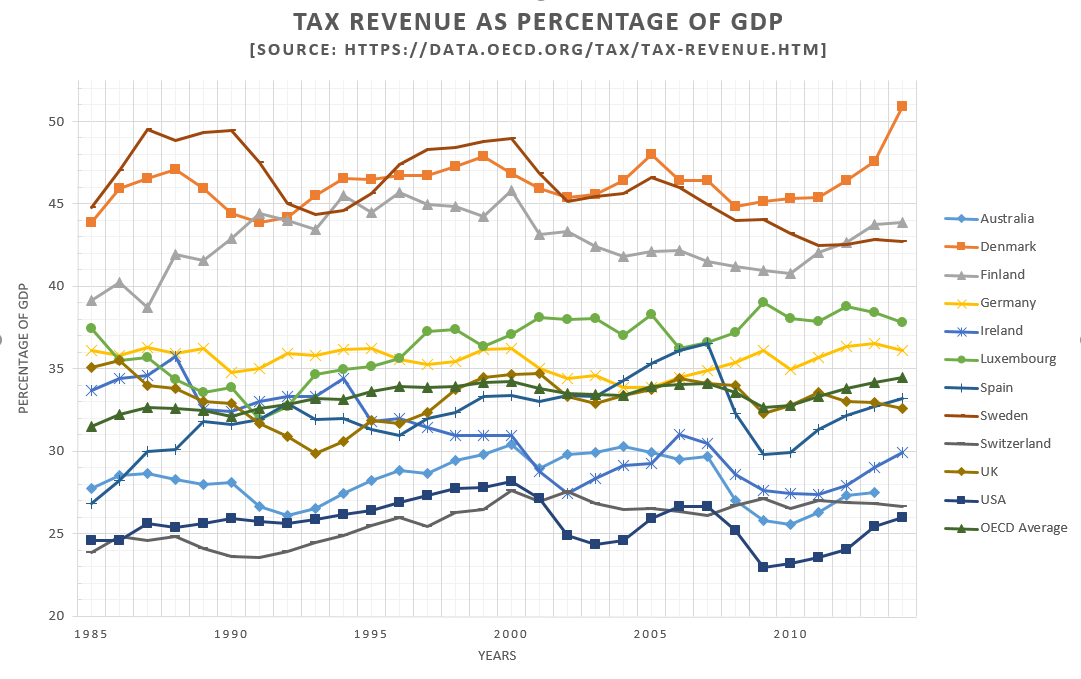

How Do Taxes Affect Income Inequality Tax Policy Center

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

What S In Biden S Capital Gains Tax Plan Smartasset

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)